Genuine Non-correlation

A True Alternative Investment

Laureola Investment Feeder Fund:

Launched in April 2013 to allow non-US investors to access the non-correlated and relatively stable returns offered by this unique asset class.

Since inception, the Laureola Investment Feeder Fund has delivered non-correlated returns through various upheavals in the traditional equity and credit markets, through volatility in commodity prices, and changes in economic conditions and unforeseen geopolitical crises. USD, EUR, CHF, GBP and AUD share classes are available.

Laureola US QP Fund:

Launched in May 2019 to allow Accredited Investors in the USA to access the non-correlated and relatively stable returns offered by this unique asset class.

Since inception the Fund has delivered non-correlated returns through various upheavals in the traditional equity and credit markets, through volatility in commodity prices, and changes in economic conditions and unforeseen geopolitical crises. Laureola’s long term performance can be reviewed by examining the results of the Laureola Investment Feeder Fund which has delivered similar returns since 2013 using an identical investment approach.

Laureola Closed-End Vintage 1 LP:

Laureola GP 1 Ltd is launching a closed end fund where Laureola Advisors will be the Investment Manager.

Laureola Advisors has demonstrated its ability to deliver cash through maturities within its open-ended funds. A closed-end fund is the right vehicle for institutional investors to access this asset class.

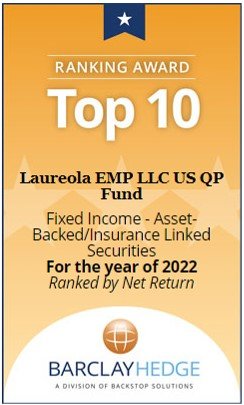

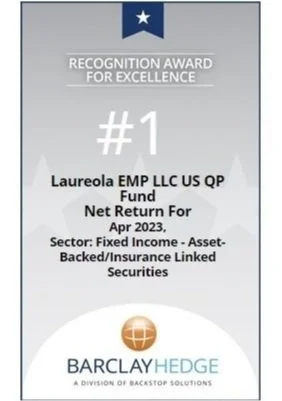

Recent Awards

Ranked by Net Return

- Sector: Fixed Income - Asset-Backed/Insurance Linked Securities

- Sector: Fixed Income - Asset-Backed/Insurance Linked Securities

![[BERMUDA FUND DECK]](https://images.squarespace-cdn.com/content/v1/5ea5320f56f3d073f3e3680e/1596903181092-ASP39OFSUALUP99XTJNS/Bermuda+Fund)

![[QP FUND DECK]](https://images.squarespace-cdn.com/content/v1/5ea5320f56f3d073f3e3680e/1596904492605-CMKRXOB4XF7S2I1XC9O8/QP+Deck)